Rare Metal Blog | About Heavy Rare Earths

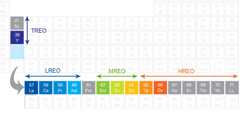

All Rare Earths |

|||

Light Rare Earths |

Medium Rare Earths |

Heavy Rare Earths |

Total Rare Earths |

Rare Earths are Not Commodities!

“Rare Earths (REE) are customer-specific chemicals, produced to precise chemical and physical specifications. The needs of the end-user must be met. Sincecustomer needs are continually evolving, it requires the suppliers to become an integral link in the supply chain.” These words are taken from REE world expert, Dudley Kingsnorth (IMCOA), March 2011.

China has been supplying the rest of the world with 97% of their rare earths since the early 1980s. However, China’s recent cutback on export quotas is creating opportunities for exploration and development by non-Chinese rare earth companies. With uncertainty in the REE supply, the race is on for these companies to be first to market.

Every company will eventually need to sign a memorandum of understanding (MoU) that will lead to the signing of one or more off-take agreements in order to sell their product. All deposits contain the 15 (or 17 including promethium and scandium) rare earth elements in varying proportions. The highest value is associated with the rarest heavy REEs or, more specifically, the 5 critical metals (Neodymium (Nd), Europium (Eu), Dysprosium (Dy), Terbium (Tb), and Yttrium (Y)) as defined by the US Dept. of Energy (Dec. 2010-2011). The supply/demand equation for individual REOs is out of balance and end-users are specifically looking for a secure supply ofthese critical elements outside of China.

Emphasis is on heavy REE deposits that show the potential to get into production quickly. To be of interest to an end-user, each company must demonstrate the technical viability of their project. Every orebody is unique, so the chemical extraction process is project specific. This process includes: beneficiation (increases REE-mineral concentration), extraction (concentrates the REEs into a pure solution), precipitation (eliminates impurities and produces a mixed REE concentrate) and separation of individual rare earths (REEs are chemically similar so they are difficult to separate). Only 5 minerals presently produce REEs (bastnaesite, the South China clays, monazite, xenotime and loparite) and projects whose ore contains these minerals are viewed as less risky despite the uniqueness of such minerals in differing orebodies. Silicate minerals, however, have not produced REEs in the past. They are viewed as more risky sources of REE, but they are typically enriched in the more desirable heavy REEs. Demonstrating a simple low cost process to produce the HREEs is the key to finding an end-user in the present race to production. Location and infrastructure are also key elements that keep the capital costs down.

It is an advantage for a REE exploration company to associate itself with an end-user that is vertically integrated from the mine to the end product. Technical expertise is limited outside China and access to the supply chain of these vertically integrated companies is imperative to fast track the projects into production. The intangible value of having a strategic partner with a complete supply chain is beyond a dollar value. Many of the junior mining companies developing REE projects are completing their metallurgical tests at the lab scale. However, the more advanced projects are preparing or completing pilot plant tests and this is often the most important step to commercialisation. This step, if successful, demonstrates that the chosen processes are technically and commercially viable through a continuously operated pilot plant(s) to produce samples to customer specification(s); to collect data for the Bankable Feasibility Study (BFS) and to complete an Environmental Impact Assessment. End-users are usually more comfortable to take a risk at this stage of the project. The perceived level of risk determines the structure of the agreement being negotiated; for example, minerals that have produced REEs in the past are viewed as less risky and more favourable terms may be negotiated.

In conclusion, negotiating an off-take agreement depends on many variables at the time of negotiation: price trends, forecast of critical REE supply shortage which takes into account the possibility of a reduction in the use of REEs and improvements in recycling methods, and the need for a secure supply of REEs outside China. Companies must build a world class negotiating team to minimize the impact of these uncertainties by signing a mixed contract: spot, long-term, etc. and fitting the off-take agreement to meet the challenges.